Seeking Agents® is a platform that connects real estate agents with motivated Buyers and Sellers who are actively seeking representation. Agents can gain access to high-quality leads and grow their business without spending a fortune on marketing.

Help Center

Frequently Asked Questions

Search or browse topics below.

Common Searches

For Buyers and Sellers:

- Save Money: Let agents compete for your business and potentially lower commission costs.

- Save Time: Skip the hassle of searching for an agent—let them come to you.

- Stay in Control: Review offers on your terms and decide when to connect.

Start today at SeekingAgents.com and experience a better way to buy or sell real estate!

For Agents:

By joining Seeking Agents®, you gain:

- Hot Leads: Direct access to Buyers and Sellers who are ready to work with an agent.

- Affordable Pricing: Plans start at just $25/month, making it one of the most cost-effective lead generation platforms in the real estate market.

- Time Savings: Spend less time hunting for leads and more time closing deals.

- Save on Marketing Budget: Reduce your marketing expenses by leveraging our platform to generate high-quality leads without additional ad spend.

Buyers and Sellers:

No, there is absolutely no cost for buyers and sellers to use Seeking Agents® to be matched with agents. The service is free, with no obligation to proceed.

Agents:Yes, the lowest-cost plan is just $25/month, making it an incredibly affordable way to connect with high-quality leads. Higher-tier plans are also available if you want even more visibility and lead opportunities.

Have questions about our current promotions?

Email us at support@seekingagents.com for more information!

No, Seeking Agents® is a cutting-edge platform designed to empower home buyers and sellers by connecting them with licensed real estate agents in a competitive marketplace. We are not a real estate brokerage and do not participate in or influence purchase or listing agreements. Instead, we focus on facilitating connections to ensure you find the right agent for your unique needs. By emphasizing transparency and choice, we help you make confident decisions for your real estate journey.

- Agents Compete for Your Business: You receive multiple offers from agents, allowing you to compare services and pricing.

- Potential Commission Savings: Because agents compete, you may secure a lower commission rate, saving you money.

- No Cost, No Obligation: Seeking Agents® is completely free for Buyers and Sellers, and you are not obligated to choose an agent.

- You Stay in Control: You decide when and if you want to share your contact information with an agent.

- Personalized Matches: Agents make offers based on your criteria, ensuring you receive proposals tailored to your needs.

By using Seeking Agents®, agents compete to represent you in buying or selling your home. This competition allows you to negotiate the commission percentage, helping you save money on your real estate transaction.

Buyers & Sellers

Seeking Agents® transforms how you find the perfect real estate agent—no more settling for whoever pops up on Zillow or Redfin.

- Top Offers: Agents compete with tailored proposals just for you.

- Easy Choice: Interview and pick the best fit, hassle-free.

- Best Value: Secure great service at a competitive price.

Not a brokerage—we connect you to smarter real estate solutions. Visit SeekingAgents.com.

Agents

Join Seeking Agents® and ditch overpriced platforms that cut into your earnings.

- Affordable: Low monthly plans, no commission fees.

- Exclusive Leads: Connect with ready clients, less competition.

- Flexible: Month-to-month, no long-term ties.

- Enter Your Buying or Selling Criteria: Provide basic details about your real estate needs.

- Agents Review Your Request: Licensed real estate agents in your area will see your request and submit offers.

- Compare Offers: Review offers from multiple agents, including their commission rates, services, and experience.

- Decide When to Connect: If you find an agent you like, you can choose to connect and start working together. Until then, your contact information remains private.

We are slowly rolling out across the nation.

To find out if we have agents, sellers or buyers in your area.

Contact us at info@seekingagents.com

Contact us at info@seekingagents.com

The NAR settlement introduces significant changes aimed at increasing transparency and fairness in real estate transactions. Here's what it means:

- More Transparency: To make real estate transactions more open and understandable for buyers and sellers, all costs must be disclosed prior to entering into an agreement with a real estate agent.

-

Upfront Commission Agreement: Real estate agents must sign a Buyer-Broker Compensation Agreement with their clients before showing any properties. This agreement clearly states the commission the buyer agrees to pay their agent. The buyer is not on-the-hook for any commissions not covered by seller's contribution.

- If the seller's contribution exceeds the agreed commission, the buyer keeps the difference.

- If it falls short, the buyer pays the remaining balance.

- Commissions are no longer known: Buyer agent commissions are no longer pre-listed on the MLS. Buyers must inquire directly with sellers to learn about any contributions towards the buyer's agent fee.

- Commission Negotiation Opportunities: The settlement encourages competition and transparency among agents. Platforms like Seeking Agents® allow agents to showcase their services and fees directly to potential clients, fostering trust and helping agents differentiate themselves in a more open market.

This settlement emphasizes clarity and fairness, empowering both buyers and agents in their real estate journeys.

No, absolutely not! You are in complete control of the process. Agents can only access your information once you decide to connect with them. Until then, your contact details remain private.

In the U.S., you are generally considered a first-time home buyer for state and federal programs if you meet the following criteria:

Federal Definition (HUD & FHA)

First-Time Home Buyer Programs by State

Federal Definition (HUD & FHA)

- You haven’t owned a principal residence in the past three (3) years.

- If you’re married, both spouses must meet the “first-time buyer” criteria.

- If you’re married, but one spouse has not been on a deed for the past three (3) years and your spouse is able to qualify for a loan on their own.

- You owned a home previously but only with a former spouse as part of a divorce.

- You have only owned a home that was not permanently affixed (e.g., a mobile home) or did not meet building codes.

State & Local Programs

Each state may have slightly different rules, but most follow the federal three-year rule. Some additional state-specific criteria include:

- Income limits (you must earn below a certain amount).

- Purchase price limits (home value must be under a set cap).

- Primary residence requirement (no investment properties).

- Homebuyer education courses (some programs require completion).

First-Time Home Buyer Programs by State

We never see or store your credit card information. All payment processing is securely handled by Stripe, ensuring your details remain completely off our platform.

We’re here to help!

You can reach out to Seeking Agents® directly via phone or email for any additional questions.

Our representatives are available during regular business hours (7 AM to 7 PM PT):

📞 Phone: 833-733-5248

For Information: info@seekingagents.com

For Support: support@seekingagents.com

We look forward to assisting you!

You can reach out to Seeking Agents® directly via phone or email for any additional questions.

Our representatives are available during regular business hours (7 AM to 7 PM PT):

📞 Phone: 833-733-5248

For Information: info@seekingagents.com

For Support: support@seekingagents.com

We look forward to assisting you!

Your information is never shared, sold, or distributed to third parties. We prioritize your privacy and ensure your data is handled securely and responsibly.

Seeking Agents® delivers leads from individuals who are actively searching for representation in their real estate transactions. These are people who have already decided they need an agent, which means they are ready to take the next step in buying or selling a property.

When a Buyer or Seller requests representation, Seeking Agents® will match their preferences (e.g., location) with agents working in the area. You’ll receive notifications for leads that align with your profile.

Understanding Offer Tokens

Offer Tokens are used to submit an offer on a Home Buyer or Seller Request. When you make an offer, the token status changes to “Unavailable”. If your offer is rejected, the token reverts back to “Available”. However, once you and the Buyer/Seller become “Connected”, the token’s status updates to “Used”, rendering it permanently unavailable.

Important Notes About Offer Tokens:

- Offer Tokens have no cash value.

- Offer Tokens cannot be transferred or sold.

- Only the agent who purchased the tokens can use them. They are tied to the agent’s account and cannot be shared.

This ensures fairness and transparency while helping agents effectively manage their lead opportunities.

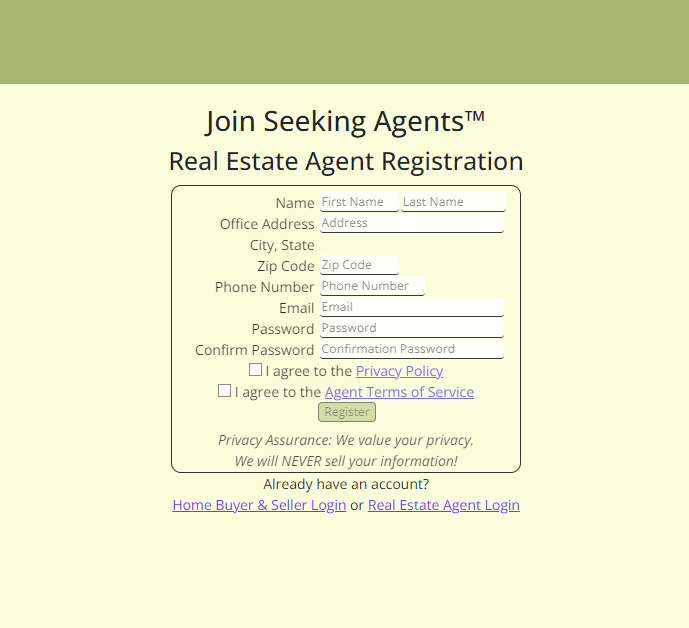

Clicking here will take you to the registration page:

Click the image to enlarge. Press 'Esc' or click outside to close.

- Enter your First and Last Name

- Enter your Office Address

- Enter your Office Address ZIP code (City and State will be automatically populated)

- Enter your email address

- Enter and reenter your password. Passwords must be 8 or more characters long

- Agree to the Privacy Policy and Terms of Service

- Click Register.

An email will be sent to you to verify that it is valid.

Click the link in the email and you are ready to log in and start connecting with Buyers and Sellers.

** All information is required.

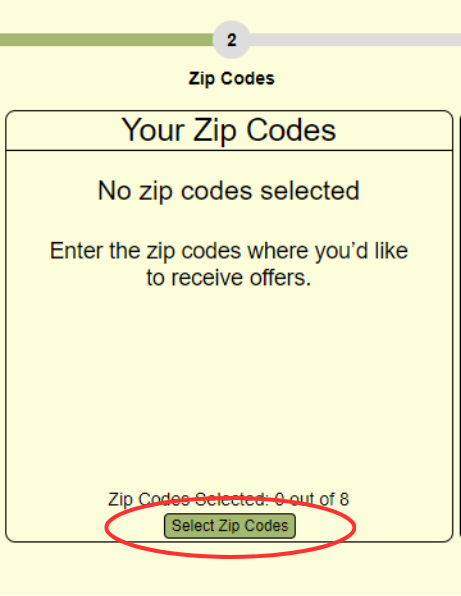

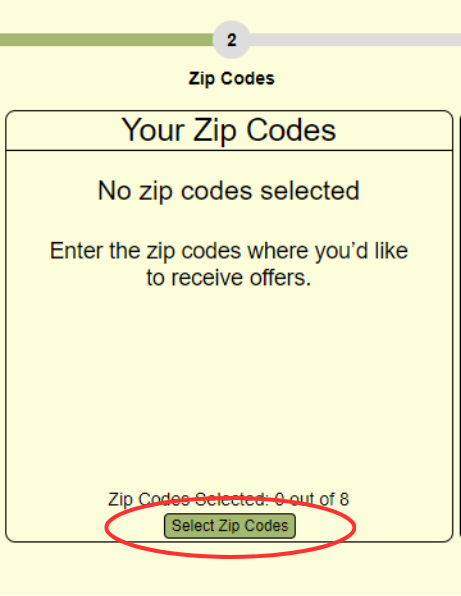

When you sign up for Seeking Agents®, you’ll have access to a specific number of ZIP codes based on your selected plan. These ZIP codes allow you to focus your business efforts in the areas where you want to connect with Buyers and Sellers.

How many ZIP codes can I select?

- Basic Plan: Includes access to 5 ZIP codes.

- Higher-tier Plans: Offer additional ZIP codes for greater coverage and more opportunities to connect with clients.

- You are limited to the number of ZIP codes allocated by your plan.

Can multiple agents select the same ZIP code?

Yes, multiple agents can choose the same ZIP code, and there is no limit to the number of agents who can have access to any particular ZIP code. With Seeking Agents®’ unique system, all agents in a ZIP code have the opportunity to receive leads fairly.

No, you are not required to use an agent from Seeking Agents®. Signing up simply allows you to receive and compare offers from agents. If none of the offers meet your expectations, you are free to explore other options. There is no commitment or obligation.

- Compare agent proposals to find the best fit.

- Ask agents questions before making a decision.

- Choose to connect with an agent when you’re ready.

If none of the offers meet your expectations, you are under no obligation to proceed.

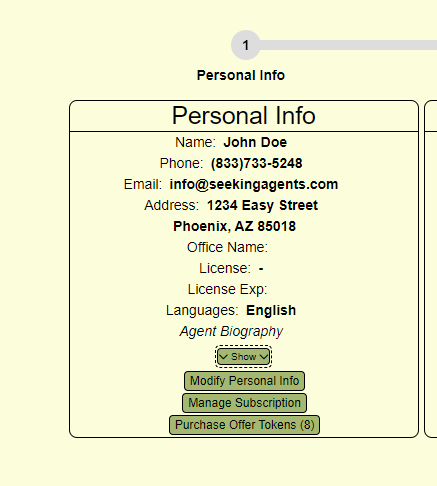

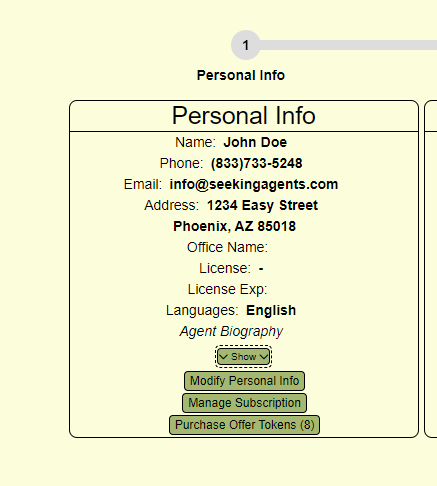

To complete your Agent Profile, you must Click the Modify Personal Info button in the Personal Info Box

Click the image to enlarge. Press 'Esc' or click outside to close.

-

After the Agent Dialog opens:

- Modify any existing personal info, if necessary

- Enter your license information. (this information is used to make sure you are a licensed agent

- Enter your Office Name

- Enter any languages you speak and a short Biography of yourself

- Click Save.

** All required information is denoted with a *

While most Buyers and Sellers receive multiple offers, availability depends on agent participation in your area. If you don’t receive offers right away, we recommend checking back later as new agents are continually joining Seeking Agents®.

On the your Agent Profile page, Click the Select/Modify Zip Codes button in the Your Zip Codes Box

Click the image to enlarge. Press 'Esc' or click outside to close.

-

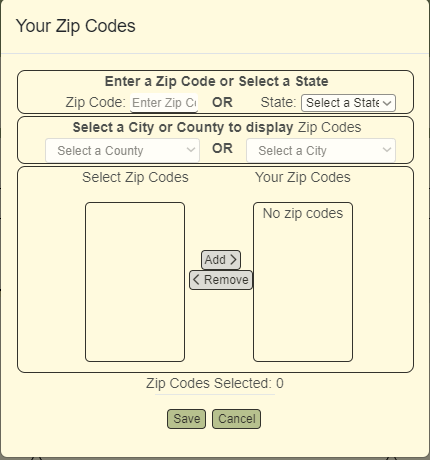

After the Agent Dialog opens you will see a screen that looks like this:

- NOTE: Agents only have access to ZIP codes in states in which they licensed

- You may manually enter one ZIP code at a time if you already know which zip codes you want and press enter

- If you would like to select from a list of available ZIP codes, you must select a County or City

- Once a County or City is selected, a list of available ZIP codes will be displayed

- On the Select Zip Codes side, select individual or multiple ZIP codes and click Add

- Selected ZIP codes will be moved to the Your Zip Code column

- Continue selecting ZIP codes up to your allowed number

- Once your selection is completed

- Click Save.

Click the image to enlarge. Press 'Esc' or click outside to close.

Your contact information is NEVER SHARED with agents until you decide to connect with one.

This means you won’t receive unwanted calls or emails until you are ready to engage with an agent.

The first step is assessing your financial readiness:

Seeking Agents® can help guide you!Take an honest look at your financial situation to determine how much house you can afford. Review your monthly income, how much you’ve saved for a down payment, and your current debts like credit cards, car loans, or student loans. Lenders use this information to calculate your debt-to-income ratio, a key factor in loan approval. The stronger your financial foundation, the better positioned you’ll be to buy a home with confidence.

Figuring out affordability is key, and Seeking Agents® makes it easy. Top agents on our platform compete to represent you, saving you on commissions while calculating your budget—typically 28-36% of your gross monthly income for housing costs (e.g., $1,167-$1,500/month on $50,000/year). They’ll factor in your savings for a down payment and closing costs, keeping your debt-to-income ratio below 43%.

A down payment is the initial cash you pay toward the home’s price, with the rest financed via a mortgage. Minimums vary:

| Loan Type | Minimum Down Payment | Example on $300,000 Home | Notes |

|---|---|---|---|

| Conventional | 3% – 20% | $9,000 – $60,000 | 3% minimum for first-time buyers; 20% avoids PMI |

| FHA | 3.5% | $10,500 | Good for lower credit scores |

| VA | 0% | $0 | Available to eligible veterans and active military |

| USDA | 0% | $0 | For rural and some suburban areas |

| Typical First-Time Buyer | 5% – 10% | $15,000 – $30,000 | More competitive offers, lower monthly payments |

PMI stands for Private Mortgage Insurance. It's a type of insurance that protects the lender—not you—if you stop making mortgage payments. PMI is usually required when your down payment is less than 20% of the home’s purchase price.

PMI can cost between 0.3% to 1.5% of your loan amount annually, and it's added to your monthly mortgage payment. Once you reach 20% equity in your home, you can usually request to have PMI removed.

Closing costs are the fees and expenses you pay when finalizing a home purchase, beyond the down payment. These can include lender fees, title insurance, prepaid taxes and insurance, and more.

On average, closing costs range from 2% to 5% of the home’s purchase price. For a $300,000 home, that’s roughly $6,000 to $15,000. Some costs are negotiable, and in certain cases, you can ask the seller to contribute toward closing costs as part of your offer.

| Closing Cost Item | Typical Amount / Range | Description |

|---|---|---|

| Realtor Commissions | 2.5% – 3% of home price | Negotiated with your agent using Seeking Agents® |

| Loan Origination Fee | 0.5% – 1% of loan | Charged by the lender to process your mortgage |

| Appraisal Fee | $300 – $600 | Pays for a professional home appraisal |

| Credit Report Fee | $25 – $50 | Covers the cost of pulling your credit report |

| Title Search & Title Insurance | $500 – $1,500 | Ensures the title is clear and protects against legal claims |

| Escrow/Closing Fee | $300 – $800 | Paid to the company handling the closing process |

| Prepaid Property Taxes | Varies | Usually 2–6 months of taxes paid upfront |

| Homeowners Insurance | $600 – $1,200 annually | Typically paid upfront for the first year |

| Recording Fees | $50 – $250 | Charged by the local government to record the sale |

| PMI (if applicable) | Varies | May include an upfront mortgage insurance premium |

Pro Tip: Using Seeking Agents® can help reduce commissions and even lower closing costs. By having real estate agents compete for your business, you may save thousands and gain more control over the home buying process.

To boost your credit score: pay bills on time, reduce credit card balances (keep utilization below 30%), avoid new credit inquiries, and dispute any errors on your credit report. A score of 620+ qualifies for most home loans, but a score of 740+ typically gets you better interest rates and loan terms. Check your score 6–12 months before applying to give yourself time to improve it.

Important: Do not make large credit purchases or open new credit accounts before or during the home buying process. New debt can negatively impact your credit score and debt-to-income ratio, which could delay or derail your loan approval.

Options include:

- Conventional: 3% down with good credit (620+).

- FHA: 3.5% down, more flexible credit (580+).

- VA: 0% down for veterans/military.

- USDA: 0% down for rural areas, income limits apply.

- State/Local Programs: Find out more here).

Yes, programs like FHA loans, VA loans, or USDA loans help with low/no down payments. Additionally, state and local governments offer grants or forgivable loans (e.g., up to $15,000 in some areas) for down payments/closing costs. Eligibility often requires income below a regional median and homebuyer education.

Find programs in your stateThe home buying process generally takes **30 to 90 days** from pre-approval to closing, though timelines can vary based on your specific circumstances. Here's a typical breakdown:

- Pre-approval: 1–2 weeks

- House hunting: Varies depending on your availability and market conditions

- Offer to acceptance: 1–7 days

- Inspection period: 7–10 days

- Closing period: 30–45 days, depending on your lender and financing

Some of these steps can overlap—for example, your lender can begin processing your loan while you're in the inspection period. Delays can occur due to financing issues, appraisal problems, or inspection findings, so it's wise to stay flexible and responsive throughout the process.

Yes, pre-approval shows sellers you’re serious and clarifies your budget. It involves a lender reviewing your finances and issuing a letter valid for 60-90 days. It’s not a final commitment but speeds up the process later.

To get pre-approved for a mortgage, lenders typically require the following documents:

- Proof of income: Recent pay stubs (usually the last 30 days)

- Tax returns: Last 2 years of federal tax returns and W-2s or 1099s

- Bank statements: Last 2–3 months of checking and savings account statements

- Identification: A valid government-issued ID (driver’s license or passport)

- Credit information: Your lender will pull your credit report with your consent

- Employment verification: Employer contact info and possibly a written verification

- Debt information: Details on any current debts, like student loans, car payments, or credit cards

Having these documents ready will help speed up the pre-approval process and show sellers you’re a serious, qualified buyer.

While it’s not legally required to use a real estate agent when buying or selling a home, having one can make the process much smoother, less stressful, and often more successful. A good agent can help you:

- Navigate the local market and pricing trends

- Find homes that meet your needs faster

- Negotiate offers, inspections, and repairs

- Handle contracts and paperwork correctly

- Connect you with trusted lenders, inspectors, and other pros

Use Seeking Agents® to help connect with a real estate agent that will work for you on your terms.

A great agent is your advocate and guide through one of the biggest financial decisions you’ll ever make—so it’s worth finding the right fit!

The main difference comes down to who they represent in the transaction:

- Buyer’s Agent: Works on behalf of the buyer. They help you find homes, schedule showings, write offers, negotiate terms, and guide you through inspections and closing. Their goal is to protect your interests and help you get the best deal.

- Seller’s Agent (also called a Listing Agent): Represents the seller. They help price the home, market it, manage showings, and negotiate offers to get the best possible terms for the seller.

While both agents may work on the same transaction, their duties and loyalty are to their respective clients. In some cases, one agent may represent both parties—this is called dual agency and is only legal in some states with proper disclosure and consent.

Having a dedicated agent on your side—whether you're buying or selling—helps ensure your needs and goals are prioritized throughout the process.

Use Seeking Agents® to find an agent that fits YOUR needs at YOUR price.

Choosing the right neighborhood is just as important as choosing the right home. Here are some key things to consider when figuring out what’s right for you:

- Commute & Transportation: How long will it take to get to work or school? Is public transportation available if you need it?

- Lifestyle & Amenities: Do you want to be near restaurants, parks, nightlife, gyms, or shopping? Think about what you do most during the week.

- Schools: Even if you don’t have kids, good schools can affect property value and future resale. If you do have kids, look into ratings and reviews.

- Safety: Check local crime rates and talk to people who live in the area to get a feel for how safe it feels day and night.

- Vibe & Community: Walk or drive around the neighborhood at different times of day. Does it feel welcoming? Do you see people out walking dogs, biking, or chatting?

- Affordability: Make sure home prices and property taxes in the area fit your budget.

- Future Growth: Look into city plans, new developments, or signs of revitalization that could affect property values over time.

Working with a local real estate agent that you find on Seeking Agents® can help you narrow things down based on your lifestyle, goals, and budget. They often know the character of different neighborhoods even beyond what online research shows.

As a first-time buyer, it’s easy to get swept up in the excitement—so it helps to focus on what really matters. Here are some key things to look for:

- Location: Choose an area that fits your lifestyle, commute, and future plans. A great home in the wrong location can quickly lose its appeal.

- Budget: Stay within your pre-approval range and remember to factor in taxes, insurance, utilities, and potential repairs or upgrades.

- Condition of the home: Pay attention to the age of the roof, HVAC, plumbing, and electrical systems. Cosmetic fixes are easier than major repairs.

- Layout & space: Think about how you’ll use the space day-to-day. Does the layout work for your lifestyle? Is there room to grow?

- Resale potential: Even if you plan to stay for a while, look for features that help with resale—like good schools, curb appeal, and a functional floor plan.

- Home inspection results: Always get a professional home inspection to uncover any hidden issues before you commit.

- Your must-haves vs. nice-to-haves: Make a list before you start touring homes so you can stay focused on your priorities.

Working with a real estate agent you find on Seeking Agents® can also help you see the big picture and avoid common first-time buyer pitfalls. It’s a big step—but with the right guidance, it can also be a smooth one!

Deciding between a fixer-upper and a move-in-ready home depends on your budget, timeline, and comfort with renovations. Here are some factors to help you weigh your options:

- Budget: Fixer-uppers often have a lower purchase price, but renovation costs can add up quickly. Be sure to budget for repairs, permits, and unexpected expenses.

- Time & effort: A move-in-ready home saves you time and hassle, while a fixer-upper requires patience, planning, and possibly temporary housing during renovations.

- Skill level: If you're handy or have access to reliable contractors, a fixer-upper can be a rewarding investment. If not, you may want to avoid major projects.

- Customization: Fixer-uppers offer the chance to design the home to your tastes. Move-in-ready homes may require some compromises on finishes or layout.

- Financing: Some loan types (like FHA 203(k)) can help finance renovations, but they have specific requirements. Traditional mortgages are simpler for move-in-ready homes.

- Market conditions: In a hot market, fixer-uppers may be one of the few affordable options. In a slower market, you may have more room to negotiate on updated homes.

Ultimately, the right choice depends on your goals, lifestyle, and willingness to take on a project. If you're unsure, your real estate agent can help assess potential homes and estimate renovation needs.

Comparing home prices across different areas helps you get a sense of value and affordability. Here are some effective ways to do it:

- Use real estate websites: Sites like Zillow, Redfin, and Realtor.com let you compare listings by neighborhood, city, or ZIP code. You can filter by price, size, features, and more.

- Check price per square foot: This metric gives you a quick way to compare the value of homes in different areas, regardless of size.

- Look at recently sold homes: Recent sale prices offer a more accurate picture than listing prices alone. Most real estate platforms include this data.

- Ask real estate agents found on Seeking Agents®: A knowledgeable agent can provide hyper-local insight into price trends, neighborhood demand, and hidden gems.

- Consider long-term value: Look at factors like school ratings, nearby development, safety, and amenities that can impact home values over time.

Taking the time to compare areas side-by-side helps ensure you’re getting the most for your money—and finding a location that fits your lifestyle and goals.

There’s no magic number when it comes to how many homes you should see—some buyers find the right fit after a few showings, while others may tour a dozen or more. The key is to feel confident in your choice. Here are some tips to help guide the process:

- Start with online research: Browsing listings online helps you get a feel for what’s available in your price range and preferred area before visiting in person.

- Focus on your priorities: Make a list of must-haves and nice-to-haves. This keeps your search focused and prevents decision fatigue.

- Quality over quantity: It’s better to view fewer homes that closely match your needs than to see dozens that aren’t a good fit.

- Take notes & compare: Keep track of what you liked and didn’t like about each property. Photos, notes, and a simple scorecard can help you remember details.

- Don’t rush—but don’t overthink: If a home checks your boxes and feels right, trust your instincts. The right one may come sooner than expected.

Work closely with your real estate agent—they can help you identify strong contenders quickly and avoid wasting time on homes that don’t meet your goals.

When a home is listed as “contingent” or “pending,” it means the seller has accepted an offer, but the sale hasn’t fully closed yet. Here’s the difference between the two:

- Contingent: The home is under contract, but the sale depends on certain conditions (or contingencies) being met—like a home inspection, financing approval, or appraisal. If any of these fall through, the deal could be canceled and the home may go back on the market.

- Pending: All major contingencies have been satisfied, and the sale is moving toward closing. It’s further along in the process than a contingent listing, but not officially sold yet.

You can still ask your agent about contingent or pending homes in case the deal falls through—but your chances of buying it are lower than with an active listing.

Online home value estimates like Zillow’s Zestimate can be a helpful starting point, but they’re just that—a starting point. They’re often off by 5–10% or more because they don’t account for things like a home’s interior condition, recent renovations, or unique neighborhood trends. For a more accurate valuation, it’s best to connect with a local real estate expert through Seeking Agents®.

Determining if a house is overpriced takes a bit of research and comparison. Here are some signs to watch for:

- Price vs. recent sales: Compare the home’s asking price to similar nearby homes (comps) that have sold recently. If it’s significantly higher without clear upgrades, it might be overpriced.

- Days on market: If the home has been sitting on the market longer than others in the area, it could be a sign the price is too high.

- No recent upgrades: A high price with an outdated kitchen, bathrooms, or major systems (roof, HVAC) might not be justified.

- Low appraisal: If you're under contract and the home appraises below the offer price, that’s a strong indicator it may be overpriced.

- Lack of interest: If there’s little buyer activity or no competing offers in a hot market, pricing may be the issue.

To get a clearer picture, connect with a local expert through Seeking Agents®. They can provide a free comparative market analysis (CMA) and help you understand whether a home is fairly priced or not.

A Comparative Market Analysis (CMA) is a report prepared by a real estate agent that estimates a home’s current market value based on recently sold, similar properties in the same area. It takes into account factors like:

- Location and neighborhood

- Home size and layout

- Condition and upgrades

- Lot size and features (like pools or garages)

- Recent sale prices of comparable homes (called “comps”)

A CMA gives you a realistic price range for a home—whether you’re buying, selling, or just curious. It’s not an official appraisal, but it’s a powerful tool for understanding local market value.

Be sure to request a free CMA from agents you connect with on Seeking Agents® to make smarter, more confident decisions when entering the market.

Making an offer on a house involves a few important steps to ensure your offer is strong and competitive. Here's a simple breakdown:

- Get pre-approved for a mortgage: Having pre-approval from a lender shows the seller you're a serious buyer with the financial backing to make a purchase.

- Work with your real estate agent: The local agent you found on Seeking Agents® will help you determine a fair offer based on comparable home sales (CMA) and current market conditions.

- Consider the offer price: Look at the asking price and adjust based on factors like home condition, how long it's been on the market, and how competitive the market is. You may offer below the asking price, full price, or above in a competitive market.

- Include contingencies: These are conditions that must be met for the deal to go through (such as home inspection, financing, or appraisal). These protect you during the process.

- Submit the offer: Once you’ve decided on your offer, your agent will submit it to the seller’s agent in writing. The seller can either accept, reject, or counter your offer.

- Negotiate: If the seller counters your offer, you can negotiate on price, contingencies, or closing dates until both parties agree.

Once your offer is accepted, you’ll move on to the next steps, including a home inspection and finalizing financing.

An earnest money deposit is a sum of money you put down when making an offer on a home to show the seller you're serious about buying. It acts like a good-faith deposit and is typically held in escrow until closing.

The amount varies depending on the local market, but it’s usually between 1% and 3% of the purchase price. For example, on a $300,000 home, you might offer $3,000 to $9,000 in earnest money.

If the sale goes through, the deposit is applied toward your down payment or closing costs. If the deal falls through due to a contingency (like financing or inspection), you usually get the deposit back. However, if you back out without a valid reason, the seller may keep it.

A local real estate agent through Seeking Agents® can help you decide on an appropriate deposit amount and make sure your money is protected throughout the transaction.

Contingencies are conditions in your offer that must be met for the sale to move forward. They protect you as the buyer and give you a legal way to back out if something goes wrong. Common contingencies to include are:

- Home inspection contingency: Allows you to have the home professionally inspected. If major issues are found, you can renegotiate or walk away.

- Financing contingency: Gives you time to secure a mortgage. If your loan isn’t approved, you can cancel the contract without losing your earnest money.

- Appraisal contingency: Protects you if the home appraises for less than your offer. You can renegotiate the price or exit the deal.

- Title contingency: Ensures the seller has a clear title to the home with no legal claims or liens that could affect your ownership.

- Sale of current home contingency (if applicable): Lets you make the purchase conditional on selling your existing home first.

The contingencies you include depend on your situation and the competitiveness of the market. A local agent through Seeking Agents® can help you structure your offer strategically and protect your interests.

Once you submit an offer, a seller typically has 24 to 72 hours to respond, depending on what’s written in the offer or local market norms. However, in a fast-moving market, some sellers may respond the same day—especially if there are multiple offers.

Here are the most common types of responses:

- Acceptance: The seller agrees to your terms, and you're officially under contract.

- Counteroffer: The seller proposes changes, such as price, closing date, or contingencies. You can accept, reject, or counter again.

- Rejection: The seller declines your offer without a counter. You can submit a new offer or move on.

During this period, your agent—especially one through Seeking Agents®—can help you stay informed, respond quickly, and navigate negotiations if needed.

If your offer is rejected, don’t worry—it's a normal part of the home buying process, especially in competitive markets. Here’s what can happen next:

- No response or outright rejection: The seller may simply decline your offer without a counter. In this case, you can choose to walk away or submit a stronger offer.

- Counteroffer: The seller might come back with different terms—like a higher price, fewer contingencies, or a different closing date. You can accept, reject, or counter again.

- Continue your search: If you can’t reach an agreement, your agent can help you find other great homes and guide you through the next opportunity with even more insight.

Remember, rejected offers are not personal. With the right strategy and a knowledgeable agent from Seeking Agents®, you’ll be in a strong position to succeed on the next one.

Yes, you can negotiate both repairs and closing costs with the seller—especially after the home inspection. It’s a normal part of the buying process, and many sellers are open to making concessions to keep the deal moving forward.

Here are a few common negotiation options:

- Request repairs: You can ask the seller to fix specific issues before closing, especially if they involve safety, structural problems, or major systems (like the roof, HVAC, or plumbing).

- Ask for a repair credit: Instead of making the repairs, the seller may offer a credit at closing so you can handle the work yourself after moving in.

- Negotiate closing costs: You can ask the seller to contribute toward your closing costs, which helps reduce your out-of-pocket expenses. This is especially common in balanced or buyer-friendly markets.

Your real estate agent—like one from Seeking Agents®—can guide you through negotiations and help structure your requests in a way that keeps the deal on track while protecting your interests.

A counteroffer happens when a seller doesn’t accept your original offer but wants to keep the negotiation going. They may change the price, closing date, contingencies, or other terms.

Here’s how you can respond to a counteroffer:

- Accept it: If you're happy with the new terms, you can agree and move forward with the contract.

- Reject it: If the changes don’t work for you, you can decline the counter and walk away.

- Counter again: You can propose your own changes in response. This back-and-forth can continue until both sides reach an agreement—or decide to part ways.

Time is important—most counteroffers come with a deadline. A skilled agent found on Seeking Agents® can help you evaluate your options, craft a strategic response, and negotiate confidently.

You’re likely in a bidding war when multiple buyers are making offers on the same property—usually driving the price above asking. Here are some signs that you may be in one:

- The home is newly listed and already has multiple offers: If your agent hears that several offers came in within a day or two, it’s a strong sign of a bidding war.

- The seller sets a deadline for offers: This often means they’re expecting multiple bids and want to choose the best one quickly.

- Your agent is asked for your “highest and best” offer: This is a clear indication that the seller is weighing multiple competitive offers.

- The price is escalating quickly: If the home is already above asking price and still receiving interest, you’re likely in a competitive situation.

If you’re in a bidding war, your real estate can help you craft a smart, strategic offer that stands out—without overpaying.

An escalation clause is a tool you can include in your offer that automatically increases your bid if a higher competing offer comes in. It tells the seller, “I’ll pay X, but if someone else offers more, I’m willing to go up to Y.”

For example, you might offer $400,000 with an escalation clause that increases your offer by $2,000 over any competing bid, up to a maximum of $420,000.

Benefits:

- Keeps your offer competitive without overpaying right away

- Saves time by avoiding back-and-forth negotiations

Risks:

- Sellers may prefer clean, straightforward offers without escalation language

- You could still end up paying more than expected

Using an escalation clause can be a smart strategy in a bidding war, but it’s not always the best fit for every situation. A local expert found on Seeking Agents® can help you decide if it makes sense based on the market and the home you're targeting.

Once your offer is accepted, you’re officially under contract—but there are still several important steps before you reach the closing table:

- Earnest money deposit: You'll submit your good-faith deposit, which is held in escrow until closing.

- Home inspection: You'll schedule an inspection to check the condition of the home. If issues arise, you may negotiate repairs or credits.

- Appraisal: If you're financing the purchase, your lender will order an appraisal to ensure the home is worth the loan amount.

- Loan approval: You'll complete the mortgage process by submitting any final documents to your lender for underwriting and approval.

- Title search & insurance: A title company will ensure the property has no legal claims and help facilitate closing. Title insurance is also purchased at this stage.

- Final walkthrough: Typically done 24–48 hours before closing to make sure the home is in the agreed-upon condition.

- Closing: You’ll sign all paperwork, pay any remaining costs, and officially become the homeowner!

An experienced agent found on Seeking Agents® will guide you through each of these steps and help avoid any surprises along the way.

Yes, getting a home inspection is highly recommended—even if the home looks perfect. A professional inspection helps uncover hidden issues like structural problems, plumbing or electrical concerns, roof damage, or mold that could cost you later.

Here’s how to arrange a home inspection:

- Schedule it promptly: Once your offer is accepted, inspections usually need to happen within 7–10 days, depending on the contract terms.

- Hire a licensed inspector: Your real estate agent found on Seeking Agents® should be able recommend trusted local inspectors.

- Attend the inspection: You’re encouraged to be there so you can ask questions and get a firsthand look at any potential issues.

- Review the report: You’ll receive a detailed report of the findings, which you can use to negotiate repairs, request credits, or in serious cases, back out of the deal (if your contract includes an inspection contingency).

Even for newer homes, a home inspection gives you peace of mind—and can save you thousands down the road.

If the home inspection reveals major issues—like foundation damage, a failing roof, electrical hazards, or plumbing problems—you have options. Here’s what you can do:

- Request repairs: You can ask the seller to fix the problems before closing. This is common if the issues are safety-related or impact livability.

- Ask for a credit or price reduction: Instead of making repairs, the seller might agree to lower the sale price or offer a credit at closing so you can handle the work yourself.

- Renegotiate terms: You can reopen negotiations based on the findings, especially if the cost to fix the issues is significant.

- Walk away: If the problems are too serious or the seller won’t cooperate—and you have an inspection contingency—you can back out of the deal without losing your earnest money.

A skilled agent found on Seeking Agents® can help you evaluate the report, get repair estimates if needed, and guide you through the next steps with confidence.

A title search is a review of public records to verify the legal ownership of a property and uncover any issues that could affect your right to own it. It’s usually conducted by a title company or real estate attorney during the closing process.

Here’s what a title search looks for:

- Outstanding liens: Unpaid debts (like taxes or contractor bills) that could be tied to the property

- Ownership history: Confirms the seller has the legal right to sell the home

- Easements or restrictions: Legal limitations or shared access that may affect your use of the property

- Judgments or legal claims: Any lawsuits or court rulings involving the property

The title search is essential for protecting your investment. If issues are found, they must be resolved before closing. You’ll also typically purchase title insurance, which helps protect you against future claims that weren’t found during the search.

Your real estate agent can help coordinate with a trusted title company to ensure everything is clear before you close.

Yes, you’ll need to purchase a homeowner’s insurance policy before closing—especially if you’re financing the home with a mortgage. Lenders require proof of insurance to protect the property (their collateral) in case of damage or loss.

Here’s what to know:

- Timing: Your policy must be active by the closing date. Most lenders require proof of coverage a few days before closing.

- Coverage: A standard policy typically covers damage from fire, storms, theft, and certain types of water damage, as well as liability protection.

- Payment: Your first year’s premium is often paid upfront at closing and may be included in your escrow account for future payments.

Your closing agent (either the title company or real estate attorney) will inform you of this requirement and guide you on when and how to provide proof of coverage. Your real estate agent—especially one found on Seeking Agents®—can also help you connect with trusted insurance providers.

An appraisal is a professional, third-party assessment of a home’s market value, usually ordered by your mortgage lender during the closing process. The appraiser evaluates the home based on recent comparable sales, condition, location, and features to ensure the property is worth the amount being financed.

If the home appraises for less than your offer:

- Renegotiate the price: You can ask the seller to lower the price to match the appraised value.

- Cover the difference: If the seller won’t reduce the price, you may choose to pay the difference out of pocket.

- Cancel the contract: If you included an appraisal contingency, you can walk away without losing your earnest money.

If the home appraises for more than your offer:

- Great news: You’re buying the home for less than it’s worth—instant equity!

- No changes needed: Your loan amount stays the same, and there’s no impact on your closing process.

Your lender, closing agent, and the real estate agent you found on Seeking Agents® will guide you through how to respond to the appraisal results and protect your investment.

Yes, in many cases you can back out of a home purchase—especially if your offer includes standard contingencies. These clauses are designed to protect you if unexpected issues come up before closing.

Here are common situations where you may be able to cancel the deal without penalty:

- Inspection issues: If the home inspection reveals major problems and you have an inspection contingency, you can walk away or renegotiate.

- Low appraisal: If the home appraises for less than your offer and you can’t reach a new agreement with the seller, an appraisal contingency allows you to exit the deal.

- Financing falls through: If your mortgage isn’t approved in time and you included a financing contingency, you won’t be forced to proceed.

- Title problems: If legal or ownership issues show up in the title search, you may be able to cancel until the issues are resolved.

If you back out for a reason not covered by your contract, you may risk losing your earnest money. That’s why it’s important to have a knowledgeable agent—like one found on Seeking Agents®—to help you structure your offer with the right protections in place.

Final mortgage approval—also known as “clear to close”—typically takes anywhere from 2 to 4 weeks after you go under contract. However, the full mortgage process from pre-approval to closing can take about 30 to 45 days in total.

Here’s what happens during the final approval stage:

- Underwriting review: After you submit all required documents (like tax returns, bank statements, and pay stubs), your lender’s underwriting team reviews everything to ensure you meet loan requirements.

- Appraisal and title check: Your lender confirms the home’s value and checks for any legal issues with the title.

- Conditions clearance: If the underwriter needs more information (called “conditions”), you’ll need to respond quickly to avoid delays.

- Final approval: Once all conditions are met, you’ll receive a “clear to close,” and your lender will schedule your closing date.

An escrow account is a special account used to hold money safely during a real estate transaction or throughout your mortgage. It helps ensure that important payments—like property taxes and homeowners insurance—are made on time.

There are two types of escrow you might encounter:

- During the home purchase: Your earnest money deposit is held in an escrow account by a neutral third party (like a title company or attorney) until closing. This protects both the buyer and seller during the transaction.

- After you buy the home: If you have a mortgage, your lender may set up an escrow account to collect a portion of your annual property taxes and insurance premiums each month as part of your mortgage payment. The lender then pays those bills on your behalf when they’re due.

Escrow accounts provide peace of mind that major payments won’t be missed. Your closing agent and lender can explain exactly how your escrow will be set up and managed.

The underwriting process is when your lender reviews all your financial information to determine if you qualify for the mortgage you’ve applied for. It typically happens after you’ve found a home and gone under contract—and can take anywhere from a few days to a few weeks.

Here’s what to expect:

- Document review: The underwriter will examine your income, assets, credit history, employment, debts, and any other required paperwork to ensure you meet the loan criteria.

- Property appraisal: They’ll review the home appraisal to confirm the property is worth the loan amount.

- Title and insurance verification: The underwriter ensures the title is clear and that you’ve secured homeowner’s insurance.

- Conditions may be requested: The underwriter might ask for additional documents (called “conditions”) before giving final approval. These could include updated pay stubs, bank statements, or letters of explanation.

- Clear to close: Once all conditions are satisfied, you’ll receive final approval and can move forward with closing.

Staying responsive and organized will help keep things moving smoothly. A skilled agent found on Seeking Agents® can help coordinate communication between you and your lender during underwriting.

“Closing” and “settlement” are often used interchangeably in real estate—and in most cases, they refer to the same event: the final step in the home buying process where ownership officially transfers from the seller to the buyer.

Here’s what typically happens during closing/settlement:

- Signing documents: You’ll review and sign all the necessary paperwork, including the loan documents and final disclosures.

- Paying closing costs: You’ll pay any remaining down payment and closing fees, usually via wire transfer or certified check.

- Transferring ownership: Once everything is signed and funds are distributed, the title is recorded in your name, and you receive the keys.

The terminology may vary depending on your region—some areas use “closing,” while others say “settlement.”

When it’s time for closing, you’ll need to bring a few important documents and items to complete the transaction. Here’s what to have ready:

- Government-issued photo ID: A driver’s license or passport to verify your identity.

- Closing disclosure: You’ll receive this at least 3 days before closing. Bring a copy for reference and to confirm all the terms.

- Certified or cashier’s check (if required): This covers your down payment and closing costs. Your closing agent will tell you the exact amount and whether a wire transfer is preferred.

- Proof of homeowner’s insurance: Lenders require an active policy before closing. Bring the declarations page or confirmation of coverage.

- Final loan documents: If your lender has sent any final documents ahead of time, bring signed copies if needed.

Your closing agent—either a title company or real estate attorney—will provide you with a full list of what’s needed for your specific transaction.

At closing, several parties may be involved—but buyers and sellers often sign their documents separately. In many cases, you and the seller won’t even be at the table at the same time.

Here’s who typically attends and what they do:

- You (the buyer): You’ll review and sign the mortgage documents, loan disclosures, and final paperwork to take ownership of the home.

- Closing agent (title company or attorney): This neutral third party manages the transaction, prepares the paperwork, collects funds, and records the new deed.

- Your real estate agent: They may attend to support you, answer questions, and help resolve any last-minute issues.

- Lender representative (sometimes): Not always present, but they may attend or be available to confirm loan details or disburse funds.

- Seller and their agent: The seller signs their portion of the documents—often before or after your signing appointment.

You will usually sign your closing documents first, often in a private appointment. The seller may sign at a different time or location, depending on the title company or attorney’s process.

Your agent, found on Seeking Agents®, and your closing agent will walk you through every step and make sure all documents are in order so you can confidently close on your new home.

While most closings go smoothly, there are a few things that can go wrong—especially if key steps were missed along the way. That’s why it’s important to stay organized and work with experienced professionals.

Here are some common issues that can delay or derail a closing:

- Last-minute loan issues: Changes in your credit, income, or employment can impact your loan approval—even at the last minute.

- Missing documents or funds: Forgetting to bring required documents or not wiring your closing funds on time can delay the process.

- Title problems: Unresolved liens, disputes over ownership, or paperwork errors can hold up the transfer of title.

- Unmet contingencies: If inspection repairs, appraisal conditions, or other contingencies haven’t been satisfied, closing may be postponed.

- Walkthrough surprises: If the home is damaged or items are missing during your final walkthrough, you may need to renegotiate before closing.

The good news? Most of these issues can be avoided with careful planning and proactive communication. Your real estate agent should work closely with your lender, title company, and the seller’s team to ensure everything is ready for a smooth closing day.

The final walk-through is your last chance to inspect the home before closing. It typically takes place within 24 to 48 hours before settlement and ensures the property is in the condition you agreed to purchase.

Here’s why it’s important:

- Confirm repairs: If the seller agreed to make repairs after the inspection, the walk-through lets you verify that the work was completed properly.

- Check for damage: You’ll make sure the home hasn’t been damaged or altered since your last visit.

- Ensure agreed-upon items are present: Appliances, fixtures, or other items that were supposed to stay with the home should still be there.

- Test systems: You can quickly test lights, plumbing, HVAC, and doors to make sure everything is functioning as expected.

The walk-through is not the time for a full inspection, but it’s a crucial step to protect your investment. If something is wrong, your agent can help you address the issue before closing.

You’ll typically receive the keys to your new home on closing day—but only after all documents have been signed, funds have been transferred, and the deed has been officially recorded with the county (which can take a few hours).

Here’s how it usually works:

- Same-day key handoff: In many cases, you’ll get the keys right after closing is completed and everything is finalized.

- Delayed recording (in some areas): In some states or counties, keys aren’t released until the deed is officially recorded, which may happen later that day or the next business day.

- Post-closing occupancy (if agreed): If the seller negotiated to stay in the home temporarily after closing (a rent-back agreement), you’ll receive the keys on the agreed-upon move-in date.

The real estate agent you found on Seeking Agents® will coordinate the key exchange and keep you updated so you know exactly when you can move in.

Closing day is a major milestone—but there are still a few things to take care of once you officially become a homeowner. Here’s what typically happens after closing:

- Receive your keys: Once the transaction is recorded and finalized, you’ll get the keys and can move into your new home.

- Set up utilities and services: Make sure electricity, water, gas, internet, trash, and other services are in your name and scheduled to start right away.

- Transfer your homeowner’s insurance: Your policy should already be in place, but it’s a good idea to confirm coverage and keep copies of your documents.

- Expect some mail: You’ll receive your official deed, mortgage documents, and other paperwork from your lender and title company in the days or weeks after closing.

- Make your first mortgage payment: Your first payment is usually due about a month after closing. Your lender will send instructions or set up an online account for you.

- Secure your home: Consider changing the locks, setting up a security system, and updating your address with the post office and other important services.

While the legal and financial part may be done, the move-in process is just beginning. Your agent, found on Seeking Agents®, can still be a valuable resource for local service providers, contractors, and advice as you settle into your new home.

If you discover problems with your new home after closing—like unexpected damage, items missing, or repairs that weren’t completed properly—it can be frustrating, but there are steps you can take to resolve the situation:

- Review your closing documents: Check your purchase agreement, inspection reports, and any repair addendums to confirm what was agreed upon in writing.

- Contact your real estate agent: A trusted agent—especially one found on Seeking Agents®—can help you understand your rights and contact the seller’s agent to try to resolve the issue quickly.

- Reach out to the closing agent or attorney: They can review what was legally documented and clarify whether the issue was addressed at closing.

- Use your home warranty (if applicable): If you received a home warranty, it may cover certain repairs or systems that fail shortly after closing.

- Seek legal advice if needed: If the issue is serious and not resolved through communication, a real estate attorney can advise you on your legal options, including potential claims for breach of contract or misrepresentation.

Most post-closing issues can be resolved through communication and documentation. Having a strong agent on your side helps you navigate any surprises with confidence.

Pre-qualification and pre-approval are both steps in the mortgage process, but they’re not the same—and understanding the difference can help you shop smarter and stand out to sellers.

- Pre-qualification: This is a quick, informal estimate of how much you might be able to borrow based on self-reported financial info (like your income and debts). It’s useful for getting a general idea of your price range, but it doesn’t carry much weight with sellers.

- Pre-approval: This is a more in-depth process where a lender reviews your actual financial documents—like pay stubs, bank statements, and credit history—to verify your ability to get a loan. You’ll receive a pre-approval letter that shows sellers you’re a serious, qualified buyer.

Bottom line: Pre-qualification is a starting point; pre-approval is a green light to shop with confidence.

When choosing a mortgage, one of the biggest decisions you’ll make is whether to go with a fixed-rate or adjustable-rate mortgage (ARM). Here’s how they differ:

- Fixed-rate mortgage: Your interest rate stays the same for the entire life of the loan (typically 15, 20, or 30 years). This means your monthly principal and interest payments remain stable, making it easier to budget long-term.

- Adjustable-rate mortgage (ARM): Your interest rate starts lower than a fixed-rate loan but can change after an initial fixed period (like 5, 7, or 10 years). After that, the rate adjusts periodically based on market conditions—meaning your payment can go up or down.

Fixed-rate loans are great if you plan to stay in the home long-term and want predictable payments. ARMs can be a smart choice if you expect to move or refinance before the rate adjusts, or if you want a lower initial payment.

Interest rates play a big role in how much your home will ultimately cost—both monthly and over the life of your loan. Even small changes in rates can significantly affect your buying power and long-term affordability.

Here’s how interest rates impact your purchase:

- Monthly payment: Higher interest rates increase your monthly mortgage payment, while lower rates reduce it—making the same home more or less affordable.

- Loan approval amount: Lenders consider your monthly payment when deciding how much to approve. If rates rise, you may qualify for a smaller loan.

- Total interest paid: Over a 30-year mortgage, a higher rate can cost tens of thousands more in interest.

- Market activity: When rates are low, more buyers enter the market—often leading to more competition. Higher rates can slow demand, sometimes leading to better deals.

Staying informed about current rates—and how they affect your budget—helps you make smarter, more confident decisions.

A real estate attorney is a legal professional who specializes in property transactions. They review contracts, ensure proper legal procedures are followed, and help protect your interests throughout the home buying or selling process.

Whether you need one depends on where you’re buying:

- Required in some states: In states like New York, New Jersey, and several others, a real estate attorney is required to be involved in the transaction.

- Optional in other areas: In states where attorneys aren’t required, title companies or escrow agents typically handle the closing. Still, some buyers choose to hire an attorney for peace of mind—especially in complex situations.

You might consider hiring a real estate attorney if:

- The purchase involves a co-op, estate sale, or foreclosure

- You’re dealing with title issues, liens, or zoning concerns

- You want a legal expert to review the purchase contract or negotiate terms

The real estate agent you found on Seeking Agents® can let you know if an attorney is needed based on your location and help you connect with a reputable one if needed.

Yes, you can absolutely buy a home if you’re self-employed—but the mortgage process might involve a few extra steps. Lenders just need to verify that your income is stable, reliable, and sufficient to cover the loan.

Here’s what you’ll typically need to provide:

- 2 years of personal and business tax returns: Lenders will review your net income (after business expenses), not just gross revenue.

- Profit and loss (P&L) statements: Especially if your income has fluctuated, lenders may want to see year-to-date financials.

- Bank statements: To show consistent deposits and cash flow.

- Business verification: This could include a business license, a letter from your accountant, or proof of active status.

Tips to strengthen your application:

- Keep personal and business finances separate

- Maintain good credit and a manageable debt-to-income ratio

- Consider making a larger down payment to increase lender confidence

Ask a real estate agent you connected with on Seeking Agents® if they can help you connect with lenders who understand self-employment and know how to present your financial picture in the best light.

Owning a home can offer several valuable tax benefits that may help reduce your overall tax bill—especially if you itemize deductions. Here are the most common advantages:

- Mortgage interest deduction: You may be able to deduct the interest paid on your mortgage for your primary residence (and possibly a second home), up to certain limits set by the IRS.

- Property tax deduction: Homeowners can usually deduct a portion of their local property taxes—up to $10,000 combined with state and local income or sales taxes (as of current federal limits).

- Mortgage insurance premiums: If you pay private mortgage insurance (PMI), those premiums may be deductible in some cases, depending on income and current tax laws.

- Home office deduction: If you work from home and meet IRS requirements, you may be able to deduct a portion of your home expenses tied to your office space.

- Capital gains exclusion: When you sell your primary residence, you may be able to exclude up to $250,000 of profit from taxes if you’re single—or up to $500,000 if you’re married and meet ownership and use requirements.

These benefits can add up, making homeownership not only a lifestyle investment—but also a potential financial advantage. A tax professional can help you understand how these deductions apply to your specific situation.

No results. Try another search term.

For informational purposes only. We are not a brokerage and do not provide legal advice.